lincoln ne sales tax 2019

Lincoln NE Sales Tax Rate. 420 W Dilin St is a 2568 square foot house on a 7841 square foot lot with 3 bedrooms and 25 bathrooms.

Form 1040N-ES 2020 Nebraska Individual Estimated Income Tax Payment Voucher.

. Tax Commissioner Tony Fulton announced the following changes in local sales and use tax rates for the upcoming quarter starting on April 1 2019. 2019 Net Taxable Sales. The average cumulative sales tax rate in Lincoln Nebraska is 719 with a range that spans from 55 to 725.

UTV and Motorboat Leases or Rentals and Instructions 04012019 10. Revenue will be generated from the increase starting October 1 and once in place will bump up Lincolns sales tax rate from the current 7 percent or seven cents on the dollar to. Lincoln on the Move.

Sale of property that is made in connection with the sale to a single buyer of all or substantially all of the property of a trade or business if the seller has previously paid sales or use tax on the. Lincoln is in the following zip codes. 2020 Sales Tax 55.

This includes the rates on the state county city and special levels. A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019. Sales Tax Table Nebraska NE Sales Tax Rates by City A The state.

The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. A yes vote was a vote in favor of authorizing the. There is no applicable county tax or.

This home is currently off market - it last sold on. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with. The Nebraska state sales and use tax rate is 55 055.

Form NOL Nebraska Net Operating Loss Worksheet Tax Year 2019. Shall the City Council of Lincoln Nebraska increase the local sales and use tax rate by an additional one quarter of one percent ¼. About This Home.

Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales. January 2019 sales tax changes. Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax.

A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated. What is the sales tax rate in Lincoln Nebraska.

2020 Net Taxable Sales. The Nebraska state sales and use tax rate is 55 055. 2019 Sales Tax 55.

The current total local sales tax rate in Lincoln NE is 7250. Local sales taxes are collected in 38 states. In April 2015 Lincoln voters approved a 14-cent increase from 15 to 175 in the City sales and use tax to support two important public.

The nebraska state sales and use tax rate is 55 055. It was approved. The minimum combined 2022 sales tax rate for Lincoln Nebraska is.

025 lower than the maximum sales tax in NE. Sales Tax Table Nebraska NE Sales Tax Rates by City A The state sales tax rate in Nebraskais 5500. The December 2020 total local sales tax rate was also 7250.

Lincoln ne sales tax 2019 Lakia Seaman from. This is the total of state county and city sales tax rates. Ballot Question April 9 2019.

Lincolns City sales and use tax rate increase.

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

Nebraska 2022 Sales Tax Calculator Rate Lookup Tool Avalara

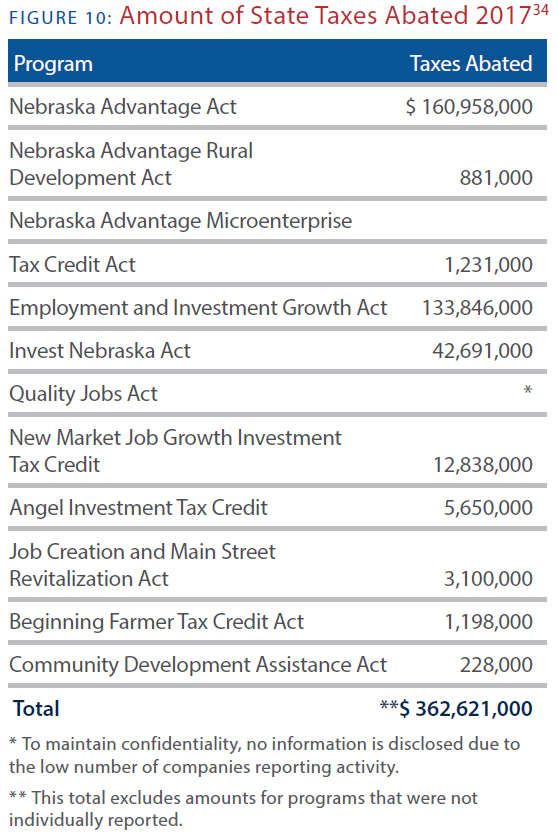

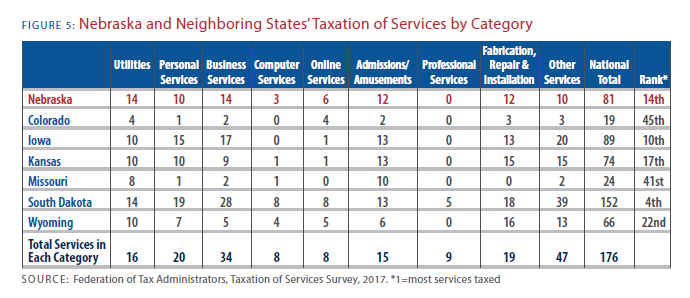

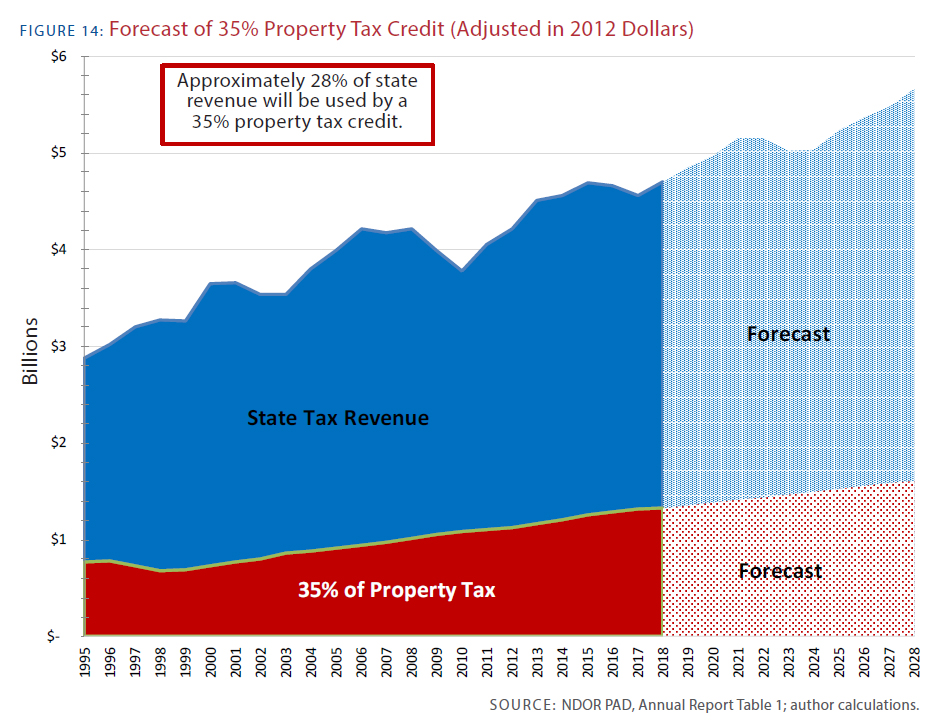

5 Essential Steps To Reform Taxes In Nebraska

Video Center Nebraska Department Of Revenue

Bottle Racket Illinois High Alcohol Taxes Blow Up Cost Of Independence Day Celebrations

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

Used Subaru Ascent For Sale In Lincoln Ne Edmunds

New Budget Analysis Highlighted Facebook Invests In Nebraska Office Of Governor Pete Ricketts

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Nebraska Group Recommends Eliminating Some Sales Tax Breaks

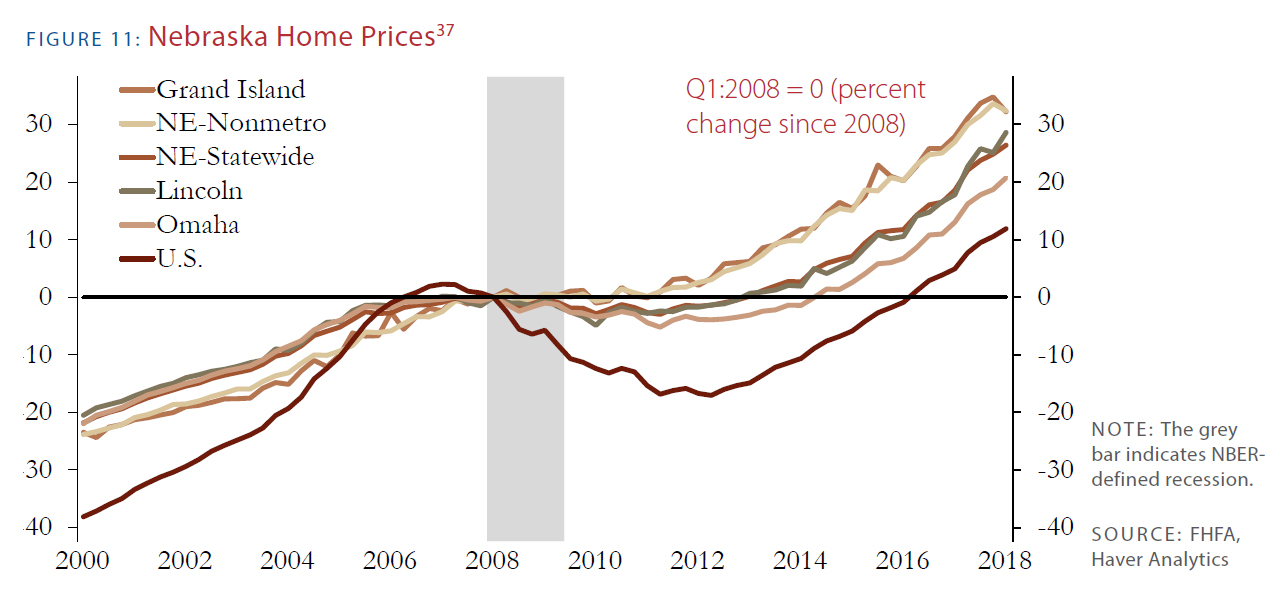

Get Real About Property Taxes 2nd Edition

Get Real About Property Taxes 2nd Edition

Get The Facts On Responsible Tax Reform Office Of Governor Pete Ricketts